All Categories

Featured

Table of Contents

Another kind of benefit credit histories your account equilibrium occasionally (each year, for instance) by establishing a "high-water mark." A high-water mark is the greatest value that a mutual fund or account has actually gotten to. After that the insurance firm pays a fatality benefit that's the better of the bank account worth or the last high-water mark.

Some annuities take your preliminary financial investment and instantly include a certain percentage to that quantity annually (3 percent, as an example) as an amount that would be paid as a death advantage. Fixed indexed annuities. Beneficiaries then obtain either the real account value or the first financial investment with the yearly rise, whichever is greater

You might pick an annuity that pays out for 10 years, but if you die prior to the 10 years is up, the staying settlements are assured to the beneficiary. An annuity fatality advantage can be practical in some scenarios. Below are a couple of instances: By aiding to stay clear of the probate process, your recipients might receive funds swiftly and easily, and the transfer is private.

What should I know before buying an Senior Annuities?

You can commonly pick from numerous options, and it's worth checking out every one of the alternatives. Select an annuity that functions in the manner in which finest helps you and your household.

An annuity aids you gather cash for future revenue needs. The most appropriate usage for revenue repayments from an annuity agreement is to fund your retirement.

This material is for informative or instructional purposes only and is not fiduciary financial investment suggestions, or a safety and securities, financial investment strategy, or insurance policy product recommendation. This product does rule out a person's very own objectives or circumstances which need to be the basis of any type of investment decision (Annuity interest rates). Investment items may go through market and various other risk aspects

How can an Fixed Indexed Annuities protect my retirement?

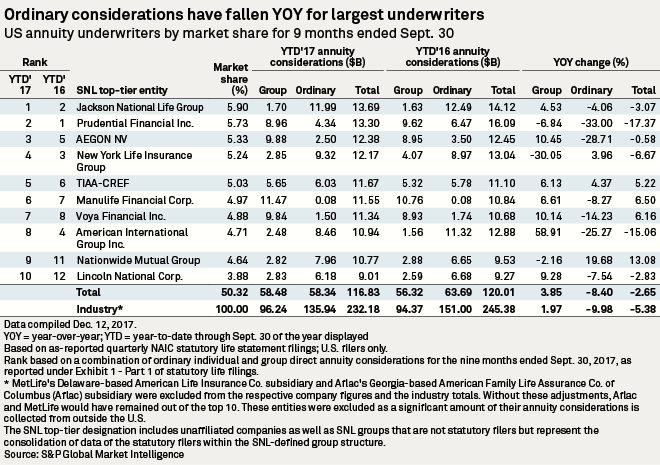

Retirement settlements refers to the annuity income received in retirement. TIAA may share revenues with TIAA Traditional Annuity owners through stated extra quantities of rate of interest during build-up, higher first annuity revenue, and with more boosts in annuity revenue advantages during retired life.

TIAA may supply a Loyalty Benefit that is only readily available when electing lifetime earnings. Annuity agreements might include terms for maintaining them in force. TIAA Standard is a fixed annuity product provided with these contracts by Educators Insurance and Annuity Association of America (TIAA), 730 Third Opportunity, New York, NY, 10017: Form series consisting of but not restricted to: 1000.24; G-1000.4; IGRS-01-84-ACC; IGRSP-01-84-ACC; 6008.8.

Transforming some or every one of your cost savings to income benefits (referred to as "annuitization") is an irreversible decision. As soon as revenue advantage settlements have actually begun, you are unable to change to another option. A variable annuity is an insurance coverage contract and consists of underlying investments whose worth is tied to market performance.

What does a basic Annuity Contracts plan include?

When you retire, you can select to receive revenue for life and/or other revenue alternatives. The real estate sector goes through various risks consisting of fluctuations in underlying property values, expenditures and income, and prospective environmental responsibilities. As a whole, the value of the TIAA Realty Account will rise and fall based upon the hidden value of the straight property, real estate-related financial investments, real estate-related safeties and fluid, set revenue investments in which it spends.

For an extra total discussion of these and other risks, please consult the program. Liable investing includes Environmental Social Governance (ESG) variables that might influence direct exposure to issuers, fields, markets, limiting the type and variety of financial investment possibilities readily available, which could result in leaving out investments that do well. There is no warranty that a varied portfolio will certainly improve total returns or exceed a non-diversified portfolio.

You can not invest straight in any type of index - Fixed-term annuities. Various other payment options are available.

There are no fees or fees to start or quit this attribute. It's crucial to keep in mind that your annuity's balance will certainly be decreased by the income payments you receive, independent of the annuity's efficiency. Revenue Examination Drive income payments are based upon the annuitization of the quantity in the account, duration (minimum of ten years), and other aspects picked by the individual.

What is included in an Annuity Income contract?

Any type of warranties under annuities released by TIAA are subject to TIAA's claims-paying capability. Transforming some or all of your cost savings to revenue advantages (referred to as "annuitization") is a permanent decision.

You will have the alternative to name multiple beneficiaries and a contingent beneficiary (a person designated to get the cash if the key recipient passes away prior to you). If you don't name a beneficiary, the built up possessions could be surrendered to a banks upon your death. It's vital to be familiar with any kind of financial consequences your beneficiary might encounter by inheriting your annuity.

As an example, your partner might have the option to change the annuity contract to their name and come to be the new annuitant (recognized as a spousal extension). Non-spouse recipients can't continue the annuity; they can only access the designated funds. Minors can not access an acquired annuity until they turn 18. Annuity proceeds could leave out someone from getting government benefits - Lifetime payout annuities.

Who provides the most reliable Immediate Annuities options?

In many cases, upon fatality of the annuitant, annuity funds pass to an appropriately called recipient without the delays and prices of probate. Annuities can pay survivor benefit several various ways, depending upon regards to the agreement and when the death of the annuitant occurs. The choice chosen impacts just how taxes schedule.

Choosing an annuity beneficiary can be as complicated as choosing an annuity in the very first place. When you speak to a Bankers Life insurance coverage agent, Financial Agent, or Investment Expert Agent who offers a fiduciary requirement of care, you can relax ensured that your decisions will certainly help you build a plan that offers security and tranquility of mind.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options Key Insights on Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of What Is Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of Dif

Analyzing Strategic Retirement Planning A Closer Look at Fixed Index Annuity Vs Variable Annuities Breaking Down the Basics of Choosing Between Fixed Annuity And Variable Annuity Benefits of Fixed Vs

Highlighting Variable Annuity Vs Fixed Indexed Annuity Everything You Need to Know About Fixed Indexed Annuity Vs Market-variable Annuity Breaking Down the Basics of Fixed Vs Variable Annuities Pros a

More

Latest Posts